What did the man in the orange hat say today?

Is the correct answer, “I don’t know, and I don’t care”?

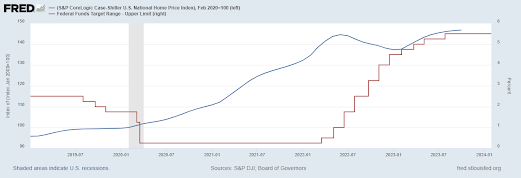

On a long enough horizon, how many times the Fed cuts rates

in 2024 is just a bump on the long, unmapped road that investors need to

navigate, a road that is filled with plenty of uncertainty. A road where the only certainty is that there

will be some unexpected twists and turns along the way. Those that can navigate the unforeseen and

the short-term setbacks on this journey are likely to reach their destination,

those that attempt shortcuts and are reckless may not. We all know that the game of predicting the

future is a tough one, filled with many losers, so speeding down the road in

search of returns based on prediction alone may not always end well. We have plenty of recent experience to know

that the biggest shocks to the economic system tend to come without warning.

Speaking of uncertainties, 2024 is an election year. Appointed to lead the Fed in 1979, Paul

Volcker was no stranger to election years.

In his memoir, Keeping At It, Volcker recounts the story of a

meeting in the summer of 1984, an election year, where he was summoned to the

White House to meet with President Reagan.

The message from Reagan’s Chief of Staff, Jim Baker, was “The president

is ordering you not to raise interest rates before the election.” Volcker laments that he wasn’t planning on

tightening policy at the time and the dilemma he faced in deciding whether to

report the incident (he didn’t), stating, “How could I explain that I was

ordered not to do something that at the time I had no intention of doing.” Volcker describes the whole incident as a

“striking reminder about the pressure that politics can exert on the Fed as

elections approach”.

The Powell Fed may find themselves in a similarly tricky

political position. The Fed may believe

that cutting rates is the correct policy but potentially worry that cutting

rates later this year may look to be politically motivated, or vice versa. In navigating the politics of an election

year, Powell would be wise to heed some advice from Volcker’s memoir,

specifically the importance of credibility in restoring price stability and

guarding against the “real danger [that] comes from encouraging or inadvertently

tolerating rising inflation and its close cousin of extreme speculation and

risk taking…”

So much attention is focused on predicting what the Fed will

do next, but what really matters for navigating the long road to investment

returns is the institutional credibility of the Fed, ultimately earned not by

words, but by actions. Actions that

ultimately create a stable environment for businesses to do their job of

solving the world’s most difficult problems.

Actions that at times mean changing interest rates and at other times

finding creative solutions to keep the banking system from imploding.

In maintaining the independence and power of the Fed that

ultimately backs its institutional credibility, which is necessary to foster a

trusting and stable business environment, my advice to Powell is to revisit

Robert Greene’s book The 48 Laws of Power with specific consideration to

the following of Greene’s laws:

Law 4:

Always Say Less Than Necessary: When you speak, always say as little as

possible. The more you speak, the more likely you are to say something foolish.

Law 5: So

Much Depends on Reputation – Guard It With your Life: Reputation is the

cornerstone of power. You can influence more people and gain more opportunities

with a solid reputation. Therefore, it is essential to protect it fiercely.

Law 9:

Win through your Actions, Never through Argument: Winning an argument gives you momentary

advantage but winning through actions gives you lasting power. Actions

demonstrate competence and create value, whereas words, often in arguments,

lead to negative emotions and resentment.

Law 20: Do Not Commit to Anyone: It is the fool who

always rushes to take sides. Do not commit to any side or cause but

yourself. By maintaining your

independence, you become the master of others.

Following these laws, over the long run, the Fed can

maintain its reputation for fostering sound money and financial stability. For

all the criticism, controversy, mistakes, and triumphs attributed to the

Federal Reserve, as an institutional system, it has served the country

well. In Volcker’s words “…it remains a

precious asset for the country in troubled times.”