- As expected the FOMC remained on hold for the third straight meeting, leaving the Fed Funds Target range at 5.25% to 5.50% with no changes to QT or other policies.

- The language in the FOMC Statement was less firm on the possibility of additional rate hikes.

- The Dots showed the Fed forecasting a 50bp lower 2023 Core PCE rate relative to estimates from September, as well as a 50bp reduction, from 5.1% to 4.6%, in the Median 2024 Fed Funds dot relative to September.

- Powell indicated the Fed remains fully committed to returning inflation to 2% goal, characterizing the current stance of policy as restrictive and cited the long and variable lags associated with monetary policy.

- Powell indicated that FOMC participants believe we are at the peak of interest rates.

- "Normalization Cuts" were discussed in the press conference, albeit poorly, but Powell acknowledged there was discussion as to when to start cutting rates as inflation cools.

- 2Y yields were down 20bps following the FOMC Statement and fell a further 10bps as Powell spoke, breaching 4.45%.

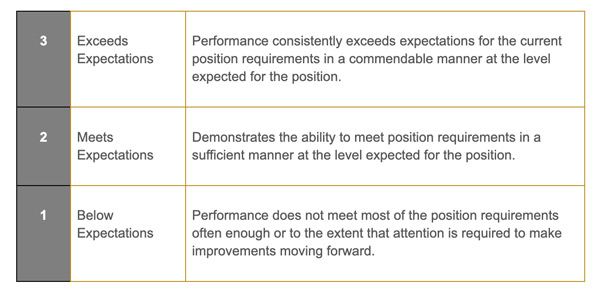

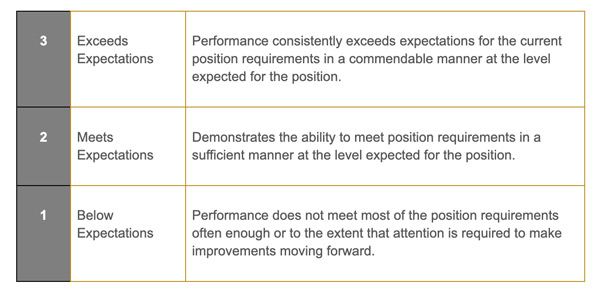

Every year most of us are forced to write down our professional goals, usually cascading down from company and team goals to you as the individual. Now is that time of year where many organizations are conducting their performance reviews. With that in mind, there is no better time than now to review the FOMC's performance for this year.

As is the case with any good performance appraisal, you should start with some objective criteria against which you are measuring performance. In the case of the FOMC, Congress specified the goals of the Fed as: (1) maximum employment, (2) stable prices, the so called "dual mandate", but there is an often forgotten third mandate in the amended Federal Reserve Act of 1977 and that is (3) moderate long-term interest rates.

Now for the appraisal:

On Maximum Employment - Exceeds Expectations: we came into 2023 with forecast for recessions which would have included job losses. The unemployment rate remains below 4% and though there may be some signs of labor market weakness, it's hard to say that the jobs picture isn't more robust than what most expected at the start of the year.

On Inflation - Needs Improvement/Below Expectations - you can argue with me until you are blue in the face that the Fed deserves a better grade here given the rapid disinflation seen in PCE and CPI data, but perhaps an example will sway you. Assume that you, as an employee, start the year with your boss telling you that the number of errors (maybe it's trading errors, maybe it's quality defects) you made was way to high last year and that the number of errors to be tolerated was 2. Your boss gave you a second chance last year because they knew there were some extenuating circumstances and you hadn't made too many of these types of errors recently, so your boss let you overshoot the error quota for a while (your boss even allowed you to change your the policy goal to "FAIT"), but said they weren't going to tolerate errors above 2 forever. You go into 2023 knowing you have to bring the level of errors back to 2, so you continue to be aggressive with your policies, they seem to be working, but your errors are still double what you were told you needed to achieve. Well, that's the Fed, they have that 2% inflation goal, but we're sitting here today a year later and we're still nearly double that rate. You wouldn't get away with that in your performance review, would you? You can tell your boss that everyone thinks your error rate will come down in the future, expectations are that they will, but would your boss keep giving you a pass?

On

Moderate Long-Term Interest Rates -

Meets Expectations - in the Federal Reserve's publication, "The Fed Explained: What the Central Bank Does" it states: ".. long-term interest rates remain moderate in a stable economy with low expected inflation...". This third mandate is never really mentioned because it seems to be dependent upon the first two topics. Certainly yields are higher than some people expected as the start of the year and they seem more moderate than they were when most of the curve was very low across the curve in the 2010's. But with so much uncertainty around things like

R* and U* it's hard to do better than "meets" here. I think the Fed did a better job on meeting or exceeding "volatile" long-term interest rates this year than they did on meeting the definition of "moderate". Arguably the rating could be worse as the Fed seemed to be relying upon tightening of financial conditions to do some work for them, with that tightening coming from higher long-term rates, and that seems to be going the wrong way as financial conditions have eased into year end.

Most reviews also include a section where the manager provides some narrative assessment of how things are going for the employee being reviewed. Here's mine for the Fed:

While progress has been made towards your goals, it's unclear how much of the success is attributable to your performance. You haven't done a great job of explaining your reaction function and often the market discounts what you are saying and believes you'll abandon your goals early if they complain loud enough. What is your reaction function? Are there rules you look at and follow to help you achieve your goals?

Your colleagues noted you did a lot of talking and many times that talking was distracting. We value a high "sit-next-to" factor here and it seems you can cause a lot of people anxiety. It seems like you spend most of your day just talking, when do you get work done? Oh, I see you think your job is mostly talking, propaganda, and suasion. We'll take this under consideration in 2024 goal setting.

Your track record of forecasting is not good. In 2024 maybe you should focus on the concept of "Margin Of Safety". In the words of Benjamin Graham in his classic book "The Intelligent Investor", Margin Of Safety is "in essence, that of rendering unnecessary an accurate forecast of the future". I know you're trying to balance both risk to unemployment and inflation, but look at where you need improvement, perhaps you might need to apply the Margin Of Safety concept to your inflation mandate.

Lastly, your performance was mixed on supervising your direct reports. Remember how several banks failed? You did a nice job of limiting the impact, but some find it troubling how this happened in the first place and how you seemed to miss the build up of economic and financial risk in years prior as well.

As we head into 2024, as you stay employed in your job of steering the most important economy in the world, I will remind you of some advice from the late, great Charlie Munger, "Nobody survives open heart surgery better than the guy who didn't need the procedure in the first place." You say you'd rather be Volcker than Burns, your goal for 2024 is to get inflation back to 2%. Let's try to get there without breaking something that will require open heart surgery.

No comments:

Post a Comment