S&P (new ATH) and Nasdaq continued to rise as we await tech earnings and the deluge of data and central bank speak yet to come. The 2Y is 4.32% and the 10Y is 4.08% with yields falling slightly following the Treasury's announcement that they expect to borrow less than market expected, we'll know more about the mix of bills and notes come Wednesday.

Yesterday, we finally learned that China's Evergrande is indeed bankrupt, something I think everyone has known for like at least 2+ years. Maybe Elizabeth Warren can fix China's property sector? It's simple, the solution to every problem is to cut rates. If housing market sucks and prices are falling, cut rates, if the housing market has rising prices, cut rates. There is literally nothing rate cuts can't cure.

In fairness to Senator Warren and the 3 other Senators who sent the letter to Jay Powell, they make some valid points. Indeed, higher borrowing cost do make it more expensive to buy a home and higher interest cost can make it more expensive to bring on new housing supply online, all good points. However, in my opinion, they missed an opportunity to really hit the Fed on all the MBS they bought through QE and how that possibly led to existing homeowners refinancing at ridiculously low rates which likely discourage them from putting their home on the market. There are likely a myriad of other factors creating supply and demand mismatches including zoning policies, WFH policies (less need to move for a job), increased boomer wealth (less need to sell, downsize, as they already have 2nd homes), as well as some of the other policy distortions that have come out of the pandemic......who knows.

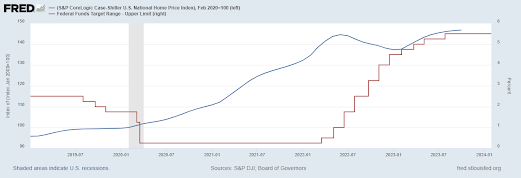

Call me crazy, but it's weird that it seems like home prices were rising the fastest when rates were near zero and they've started to level off now that the Fed has hiked rates...

On the day ahead it's JOLTS as the highlight.

XTOD: Market summary: Janet Yellen launched another drone attack on bears.

XTOD: Buffett held up stacks of paper and said, “Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it. - The Joys of Compounding

XTOD: 1/ What is a compounder? "High quality, franchise businesses, ideally with recurring revenues, dominant & durable intangible assets, pricing power and low capital intensity. We focus on franchise quality, durability, financial strength, industry position, & management quality"..... Key characteristics:

• High ROIC • High margins • Recurring revenues • Low capital intensity• Innovation-driven • Pricing power • No excess debt • Quality management • Low cyclicality • Resilient in downturns • High barriers to entry • Organic growth potential...Avoid traps like: • Fading companies • Highly acquisitive companies - where mgmt are not disciplined • Poor or greedy mgmt • Overdependence on single product • Cuts to R&D, marketing, development • Mgmt with short-term focus https://t.co/I8y4BGcAA4

XTOD: American men are stuck in what’s been dubbed a friendship recession, with 20% of single men now saying they don’t have any close friends, an all time high, per PBS.

XTOD: Working on becoming a combination of Erlich from Silicon Valley, Walter from The Big Lebowski, and Phil Connors from Groundhog Day

https://x.com/NorthmanTrader/status/1752075342850761090?s=20

https://x.com/joyofcompoundin/status/1751946499682918721?s=20

https://x.com/KoyfinCharts/status/1751662731961524572?s=20

https://x.com/unusual_whales/status/1752010464777658738?s=20

https://x.com/Noahpinion/status/1751711215955648803?s=20

No comments:

Post a Comment