FOMC Day is here. Check back after Powell's presser for a recap. Yesterday's JOLTS showed an increase in openings, but subdued quits is seen as a sign of some loosening in the job market. Consumer confidence remained solid and while stocks were relatively flat, after hour earnings from Alphabet and Microsoft were viewed as weaker than expected. Yields fell a few bps with the 2Y at 4.32% and the 10Y at 4.02%. Overseas China's economy and the two wars are still a mess.

"We think they are days from failure. They think it is a temporary problem. This disconnect is dangerous."

Wednesday, January 31, 2024

Daily Economic Update: January 31, 2024

Tuesday, January 30, 2024

Daily Economic Update: January 30, 2024

Monday, January 29, 2024

Daily Economic Update: January 29, 2024 (finfluencers, civilization and an FOMC preview?)

On the week ahead: Tuesday: JOLTS, Wed: ADP, ECI and FOMC, Thur: Jobless claims, ISM mfg, Friday: Jobs Day in 'merica

Social media influencers are becoming a key vehicle to promote products and services, including in the financial services sector. This development has given rise to the neologism “finfluencer” (financial influencer). Finfluencers represent a new intermediary betweenfinancial institutions and consumers. They provide general investment information, promote investment products, offer guidance, and, in some instances, make investment recommendations. It is often unclear whether finfluencers are authorised to conduct regulated activities; however, they have become an important source for young investors—particularly those aged 18–25, who are part of Generation Z—to access investment information.

While social media is definitely a relatively new phenomenon, the challenges of poor information, disinformation, etc. is anything but new. In fact you could argue it is an inevitability of becoming "civilized", at least economist and philosopher John Stuart Mill considered this inevitability to be the case all the way back in 1836 in his essay titled "Civilization". Mill defined "civilized society" by contrast to barbaric or rude society;

"We accordingly call a people civilized, where the arrangements of society, for protecting the persons and property of its members, are sufficiently perfect to maintain peace among them; i.e. to induce the bulk of the community to rely for their security mainly upon social arrangements, and renounce for the most part, and in ordinary circumstances, the vindication of their interests (whether in the way of aggression or of defence) by their individual strength or courage."

Mill argues that the attainment or advancement to a civilized state requires a diffusion of property and knowledge, combined with the power of cooperation. However, Mill recognized some consequences that come from obtaining and growing civilized society, including that "the importance of the individual, as compared to the masses, sink into greater and greater insignificance." [Side bar: Professor and author Dr. Michael Muthukrishna in discussing his book, A Theory of Everyone, posits that one of the pivotal moments towards what he calls "the securitization of trust" necessary in fostering the diffusion of property and knowledge was the Catholic Church banning cousin marriage. He sees this as largely ending kinship based tribalism, which further leads to humans learning to cooperate and build trust beyond the familial structure.]

- The individual becomes so lost in the crowd, that though he depends more and more upon opinion, he is apt to depend less and less upon well-grounded opinion; upon the opinion of those who know him.

- There has been much complaint of late years, of the growth, both- in the world of trade and in that of intellect, of quackery, and especially of puffing: but nobody seems to have remarked, that these are the inevitable fruits of immense competition; of a state of society where any voice, not pitched in an exaggerated key, is lost in the hubbub. Success, in so crowded a field, depends not upon what a person is, but upon what he seems: mere marketable qualities become the object instead of substantial ones, and a man's labour and capital are expended less in doing anything, than in persuading other people that he has done it

- It is our own age which has seen the honest dealer driven to quackery, by hard necessity, and the certainty of being undersold by the dishonest. For the first time, arts for attracting public attention form a necessary part of the qualifications even of the deserving: and skill in these goes farther than any other quality towards ensuring success

- It corrupts the very fountain of the improvement of public opinion itself; it corrupts public teaching; it weakens the influence of the more cultivated few over the many

- The world reads too much and too quickly to read well

- when almost every person who can spell, can and will write, what is to be done? It is difficult to know what to read, except by reading everything; and so much of the world's business is now transacted through the press, that it is necessary to know what is printed, if we desire to know what is going on. Opinion weighs with so vast a weight in the balance of events, that ideas of no value in themselves are of importance from the mere circumstance that they are ideas, and have a bonâ fide existence as such anywhere out of Bedlam

While Mill expressed concerns over civilization causing a loss of individual energy (loss of courage, work ethic, patience, etc.) and a weakening of the influence of superior minds, he believed that the answer wasn't to limit diffusion of knowledge, but to establish counter-tendencies by further perfecting means of cooperation and reforming education and politics.

The problems of Mill's 1836, seem quite similar to some of the problems of our current day and some of the reforms he discusses seem eerily similar to some debates around higher education today.

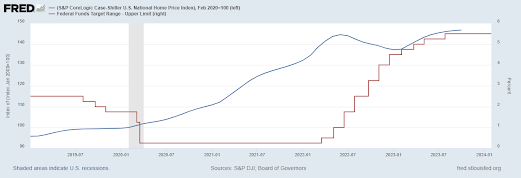

So what's the lesson? Perhaps it is that when listening to Powell this week, take a longer view. The Fed is part of a fabric of institutions that have been developed over time to help "securitize trust" and foster societal cooperation. If you believe that societal cooperation solves problems and makes a better world, then what the Fed does with 25 or 100 basis points here or there over the next month or year is likely far less relevant than whether you believe that in the long-run, institutions like the Fed, remain somewhat credible in fostering a stable environment for businesses to solve problems. If you think that over time our ability to remain civilized holds, then it's a case for optimism, a topic I mentioned here.

XTOD: Doing less meaningless work, so that you can focus on things of greater personal importance, is NOT laziness. This is hard for most to accept, because our culture tends to reward personal sacrifice instead of personal productivity. Let’s define “laziness” anew—to endure a non-ideal existence, to let circumstance or others decide life for you, or to amass a fortune while passing through life like a spectator from an office window. The size of your bank account doesn’t change this, nor does the number of hours you log in handling unimportant e-mail or minutiae. Focus on being productive instead of busy.

XTOD: the spouses of the very rich are the dark matter of american politics

XTOD: Taylor Swift performs in Japan the night before the Super Bowl. It will end around 10pm Tokyo time (5 am Las Vegas time). The flight from Tokyo to Vegas takes 12 hours, meaning Swift can arrive at 5pm local on the day before the Super Bowl, 25 hours, 35 mins before kickoff.

Friday, January 26, 2024

Daily Economic Update: January 26, 2024

Thursday, January 25, 2024

Daily Economic Update: January 25, 2024

Real optimists don’t believe that everything will be great. That’s complacency. Optimism is a belief that the odds of a good outcome are in your favor over time, even when there will be setbacks along the way.

,,,,But the most powerful and important book should be called “Shut Up And Wait.” It’s just one page with a long-term chart of economic growth. Physicist Albert Bartlett put it: “The greatest shortcoming of the human race is our inability to understand the exponential function.”

One thing that can risk interrupting compounding unnecessarily and not allowing you to achieve the long-term optimism is excessive leverage. "It pushes routine risks into something capable of producing ruin." We've talked about leverage recently...go back to January 10th post on Howard Mark's "Easy Money" memo.

Wednesday, January 24, 2024

Daily Economic Update: January 24, 2024

Tuesday, January 23, 2024

Daily Economic Update: January 23, 2024

"Although it is not certain that anyone will be ever able to prove conclusively whether or not bubbles exist, research shows that many famous financial crisis that have been portrayed as bubbles were not bubbles at all."

DeRosa references Occam's razor, which calls for always seeking the explanation that makes the fewest assumptions possible, and Mark Rubinstein's The Prime Directive, which says that you should attempt to explain asset prices by rational models as reasons to search first for fundamental, rational explanations for asset prices before resorting to "bubbles" as the last resort. If you want to hear DeRosa speak on the topic of Bubbles, he was interviewed here. If you're not familiar with the story of John Law and the Mississippi Company, listen around the 11 minute mark for a quick overview, though Niall Ferguson's account in The Ascent of Money is much better in my opinion.

Are markets rational? I'll leave it to those smarter than me to answer. While I believe Ben Graham believed in efficient market hypothesis, his parable of "Mr. Market" is always worth a read and reminder.

Monday, January 22, 2024

Daily Economic Update: January 22, 2024

- Duration Neutral - you Buy/Long 2Y Treasury Note Futures while simultaneously Sell/Short 10Y Treasury Note Futures with both legs of the trade sized to have the same Dv01 (generally you are short a lower quantity of 10Y note contracts than you are long 2Y note contracts).

- Bull Steepener (you think short-term yields will fall more quickly than long-term yields) - you Buy/Long more Dv01 in 2Y Note Futures than you are Short Dv01in 10Y Note futures. The idea here is you think the steepening of the curve will come from lower 2Y yields. You run risk that the curve steepens but the steepening is a result of the 2Y falling moreso than from the 10Y rising.

- Bear Steepener (you think long-term yields will rise more quickly than short-term yields) - you Sell/Short more Dv01 in the 10Y Note Futures then you Long Dv01 in the 2Y Note futures. The idea here is you think the steepening of the curve will come from higher 10Y yields moreso than lower 2Y yields.

-

We spend endless time debating the Fed’s neutral rate. Much less time asking whether the government can afford it. Enter Fiscal r-star : t...

-

U.S. yields start the day lower, with the 2Y down 4bps back at 5% and the 10Y down 6bps at 4.26%, both back to where they were pre-SVB (reme...

-

Yesterday the FOMC: Held their policy rate at 5.25-5.50% Raised their growth and inflation projections while keeping their median 2024 proj...

Edward Quince's Wisdom Bites: Low Ego

Nas closes his masterclass with a lesson on temperament: “The liquidity is high, but the ego is low / Light years ahead of where the paper u...