"We think they are days from failure. They think it is a temporary problem. This disconnect is dangerous."

Tuesday, October 1, 2024

Daily Economic Update: October 1, 2024

Monday, September 30, 2024

Daily Economic Update: September 30, 2024

Happy last day before we start the 4th quarter. On Friday, PCE data was waeker than expected in the MoM core at 0.13%, yet the YoY rate increased to 2.7%. I'm not sure it mattered as markets seem much more focused on Chinese stimulus and labor markets for the moment, where the focus will shift to this Friday's job's report.

We ended the week with Atlanta Fed's GDPnow estimate for 3Q2024 revised up to 3.1%. The NY Fed nowcast is in general agreement at 2.99%. Stocks in general agreement that things aren't bad (or maybe they just believe in the Fed put). The 2Y is 3.57% and the 10Y at 3.75%.

Away from markets you have historic flooding as a result of Helene and continued dismantlement of Hezbollah leadership by Israel. Not top of mind for many is the fact that Oct.1 starts the resumption of normal collections, late fees, reporting to credit agencies, etc. for student loans.

On an unrealted note, if you're looking for a perhaps under the radar podcast on AI, I thought this podcast with Edward Chancellor and Marathon Asset Management was interesting https://shows.acast.com/66acfe26e65b9fd5b02a0fcd/66b22e2fec20c36e8ebf8542

6-month annualized rate: 2.4% (lowest since Dec)

3-month annualized rate: 2.1%

XTOD: I think about this often, living in a tech transplant-centric area On a given weekday, I see moms and dads shopping together, at the gym for 9 am yoga, walking dogs at 10 am, picking up kids from school at 3 pm…etc Part of me celebrates that we’ve unlocked this level of work/life balance It’s an enormous quality of life booster for working parents with kids But part of me also fears this is “too good to be true” Perhaps a number of these jobs are disposable, or at the very least, transferable overseas Perhaps some of these couples are semi-retired, living off a wealth effect that may dwindle away in a stock market correction, or if inflation relentlessly drives cost of living higher Time will tell.

XTOD: Google breached the mindshare moat w a spartan web page that was fast - and an AOL deal that raised awareness - kids started “googling”. And then it was over. Technology is required but not sufficient - mindshare is lightening in a bottle that triggers network effects. 💥

XTOD: And these foreign interests trying to cash in on big city real estate development are just following the example set by our own home-grown developers who've been bribing mayors, inspectors, and local politicians for decades to build "luxury" developments that charge obscene rents

XTOD: Modern life rewards distraction and consumption. But fulfillment comes from focus and simplicity. Reclaim your time. Reclaim your health. Reclaim your life.

Friday, September 27, 2024

Daily Economic Update: September 27, 2024

Thursday, September 26, 2024

Daily Economic Update: September 26, 2024

Wednesday, September 25, 2024

Daily Economic Update: September 25, 2024

China eases, cutting their RRR by 50bps which should open up over $140bln in new loans. Chinese authorities also cut certain repo and mortgage rates by 20bps, while making some regulator changes to spur demand for homes and stocks. Elsewhere in Asia, BoJ talked tough on inflation and the Aussie central bank held rates at 4.35% for the 7th straight meeting, so far abstaining from the rate cutting frenzy as they remain vigilant against inflation risk.

Tuesday, September 24, 2024

Daily Economic Update: September 24, 2024

I have no clue what views will be right in 2024, but I'm going to guess that the advice Paul Volcker left in his 2018 biography, "Keeping At It", may not be entirely lost on JPOW. That advice is: "A lesson from my career is that such successes [in maintaining low inflation] can carry the seeds of its own destruction. I've watched country after country, faced with damaging inflation, fight to restore stability. Then, with victory in sight, the authorities relax and accept a "little inflation" in the hope of stimulating further growth, only to se the process resume all over again."

Monday, September 23, 2024

Daily Economic Update: September 23, 2024

|

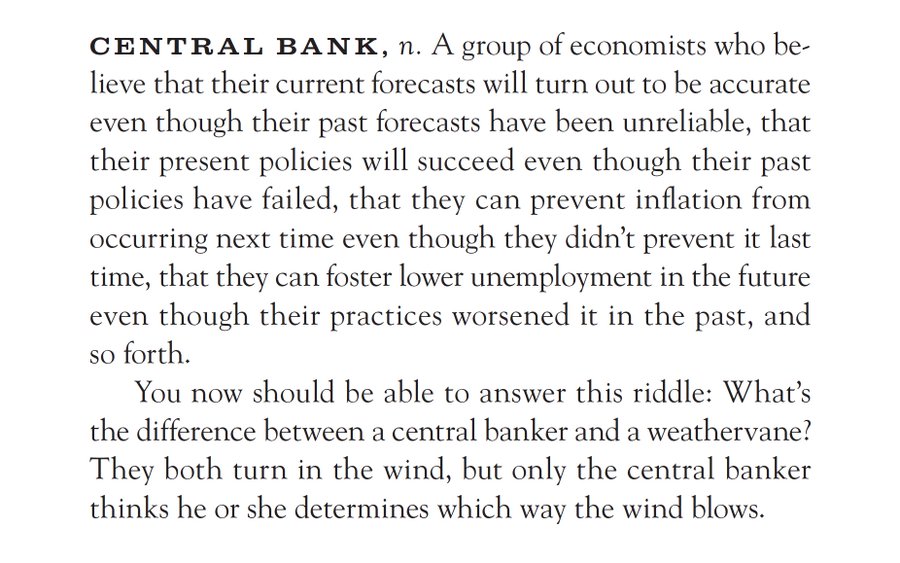

| From: 'The Devil's Financial Dictionary" by Jason Zweig |

The irony of maintaining a daily economic update blog while firmly believing it is best to ignore all of the noise and false stimuli is not lost on me. If you’re paying attention it’s the message of this blog that you can’t predict the future and it's a waste of time to focus on the noise or "what the world looked like ten minutes ago."

"the "short-term crowd" responds constantly to "false stimuli" whether it's the latest economic data point or the trivial news that a company has beaten analysts' expectations. "You need to be wired not to believe the bullshit, to not be listening." - William Green discussing and quoting Nick Sleep (if you don't know who Nick Sleep is google Nomad Partners investment letters)

"All of humanity's problems stem from man's inability to sit quietly in a room" - Blaise Pascal

Friday, September 20, 2024

Daily Economic Update: September 20, 2024

Lowering interest rates can help prevent a weakening in employment without risking a rise in inflation through several key mechanisms. First, lower interest rates can stimulate aggregate demand, boosting economic activity and employment. This is because lower rates make borrowing and spending cheaper for households and businesses....others caution that the Fed's Flexible Average Inflation Targeting (FAIT) framework made the central bank reluctant to raise rates until employment had fully recovered and the Fed should consider a more symmetric framework that is less tied to employment outcomes.Additionally, depending on the natural rate of unemployment, which may have risen temporarily due to pandemic-era dynamics, lowering rates could help bring more workers back into the labor force without necessarily stoking high inflation, as the unemployment rate may be above its new, higher natural level.

-

U.S. yields start the day lower, with the 2Y down 4bps back at 5% and the 10Y down 6bps at 4.26%, both back to where they were pre-SVB (reme...

-

Stocks rose, the yield curve steepened. Powell indicated he's good to cut rates before inflation returns to 2%. 2's10's cu...

-

Sure, why not have an extra day every 4 years? Yesterday stocks moved lower and bond yields fell a few bps. The 4Q GDP showed a 3.2% rate, r...

Edward Quince’s Wisdom Bites: We Are The Market

Missed posting last week, whoops! I won't make it up to you. We spend an inordinate amount of time discussing "the market" or...