China eases, cutting their RRR by 50bps which should open up over $140bln in new loans. Chinese authorities also cut certain repo and mortgage rates by 20bps, while making some regulator changes to spur demand for homes and stocks. Elsewhere in Asia, BoJ talked tough on inflation and the Aussie central bank held rates at 4.35% for the 7th straight meeting, so far abstaining from the rate cutting frenzy as they remain vigilant against inflation risk.

"We think they are days from failure. They think it is a temporary problem. This disconnect is dangerous."

Wednesday, September 25, 2024

Daily Economic Update: September 25, 2024

Tuesday, September 24, 2024

Daily Economic Update: September 24, 2024

I have no clue what views will be right in 2024, but I'm going to guess that the advice Paul Volcker left in his 2018 biography, "Keeping At It", may not be entirely lost on JPOW. That advice is: "A lesson from my career is that such successes [in maintaining low inflation] can carry the seeds of its own destruction. I've watched country after country, faced with damaging inflation, fight to restore stability. Then, with victory in sight, the authorities relax and accept a "little inflation" in the hope of stimulating further growth, only to se the process resume all over again."

Monday, September 23, 2024

Daily Economic Update: September 23, 2024

|

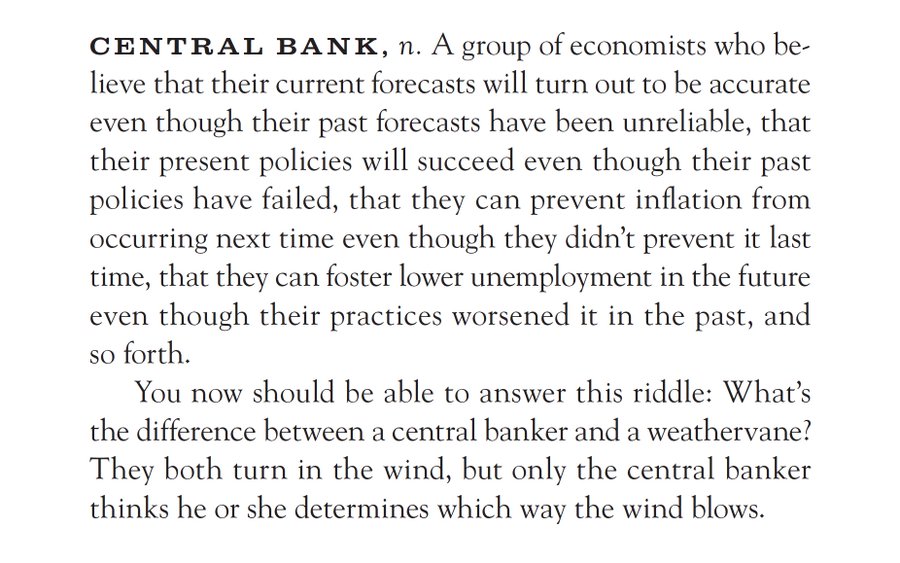

| From: 'The Devil's Financial Dictionary" by Jason Zweig |

The irony of maintaining a daily economic update blog while firmly believing it is best to ignore all of the noise and false stimuli is not lost on me. If you’re paying attention it’s the message of this blog that you can’t predict the future and it's a waste of time to focus on the noise or "what the world looked like ten minutes ago."

"the "short-term crowd" responds constantly to "false stimuli" whether it's the latest economic data point or the trivial news that a company has beaten analysts' expectations. "You need to be wired not to believe the bullshit, to not be listening." - William Green discussing and quoting Nick Sleep (if you don't know who Nick Sleep is google Nomad Partners investment letters)

"All of humanity's problems stem from man's inability to sit quietly in a room" - Blaise Pascal

Friday, September 20, 2024

Daily Economic Update: September 20, 2024

Lowering interest rates can help prevent a weakening in employment without risking a rise in inflation through several key mechanisms. First, lower interest rates can stimulate aggregate demand, boosting economic activity and employment. This is because lower rates make borrowing and spending cheaper for households and businesses....others caution that the Fed's Flexible Average Inflation Targeting (FAIT) framework made the central bank reluctant to raise rates until employment had fully recovered and the Fed should consider a more symmetric framework that is less tied to employment outcomes.Additionally, depending on the natural rate of unemployment, which may have risen temporarily due to pandemic-era dynamics, lowering rates could help bring more workers back into the labor force without necessarily stoking high inflation, as the unemployment rate may be above its new, higher natural level.

Thursday, September 19, 2024

Daily Economic Update: September 19, 2024 (Kind of a FOMC Recap?)

We know the Fed cut 50bps and are "forecasting" another 50bps of cuts this year and another 100 next year. We also know there was a Governor dissent for the first time since 2005. Powell stressed greater confidence in inflation reaching target, no one asked if the Fed's FAIT (flexible average inflation targetting) should be symmetrical, and that Powell believes labor markets are no longer a source of inflation. The median dots show a Fed that sees unemployment rising in the face if falling rates even as inflation slowly returns to target. Powell said something about the possibility of the neutral rate being higher. I don't recall much discussion about fiscal policy and overall the Fed will make decisions on the basis of the evolution of the economy.

I didn't write a FOMC Recap for this one. If I had written a recap, I might have focused on a Howard Marks concept I wrote about earlier in the week that he calls "the perversity of risk". Conceptually it is the paradox that risk is highest when market participants perceive it to be the lowest. Under that paradox there are two initial questions I think are worth considering following the FOMC meeting today: (1) is the Fed too confident about the risk surrounding inflation? and (2) are investors too confident about macroeconomic risk in general as they bid stocks and bonds both to recent highs? In regards to the second question are investors actually too complacent in the risk related to employment. With regards to both of these questions, I have no answers, only more questions.

If I were to have written a recap, I'd probably stick with some themes from Marks writings and try to think about how they apply to monetary policy and the current stance of the Fed's policy. Marks says "Not trying to maximize is an important component in preparing for what life throws at you...". I might try to discern if the 50bp cut is an attempt not to maximize the fight against inflation, or whether it's actually a 'mistake' in the Fed trying to maximize employment. I might try to think about whether a 50bp cut leads to a less fragile economic outlook, one that will be more resilient to shocks, or whether it creates vulnerabilities to positive shocks that spur reignite inflation.

Ultimately if I were to write an FOMC recap, I might borrow thinking from William Green's book "Richer, Wiser, Happier" and his chapter about Marks titled "Everything Changes". I might talk about Marks thinking around impermenance. About how we can't predict the future, not only do we don't know what will happen, often we don't even know what could happen. About how we shouldn't cling to things that we know can't last. About thinking in terms of preparation rather than prediction. About discipline rather than biases and emotion. About how we shouldn't waste our time trying to predict interest rates, inflation, growth, or other things that are influenced by so many factors with randomness. About how investor psychology historically creates cycles. About looking at things in terms of "Where's the mstake?" And about "bearing risk intelligently while never forgetting about the possibility of an unpleasant outcome."

I think I'd write something about that and conclude it with a statement simply saying "I don't know."

If you were to have written a FOMC recap what would you write?

Twitter/X Thoughts of the Day will return tomorrow.

Wednesday, September 18, 2024

Daily Economic Update: September 18, 2024

Tuesday, September 17, 2024

Daily Economic Update: September 17, 2024

It's interesting to look back at what we were talking about a year ago. Does anyone even remember the UAW strike and how that would be inflationary? Funny that the Boeing strike isn't painted in the same light. And then go look at the September 2023 meeting (recap here). That was the first meeting following the last rate hike. We had 2Y yields around 5% (compared to 3.56% now) and the 10Y yield around 4.30% (compared to 3.52% now). At the time of that meeting, the median dot showed one more hike in 2023 and removed two cuts from 2024, effectively projecting just 50bps in cuts for all of 2024 at the time. Obviously new data changed the views as 2024 progressed, but if monetary policy didn't change, must it have been "shocks" to the economy that caused the sudden slowing? Or was it that estimates of the "long and variable lags" were wrong in 2023? Or was it the elusive r* (neutral rate) was missestimated? Supply chains? China's weakness? Or none of the above? Or some combination of the above?

"high interest rates raise the incentive to save, which in turn dampens consumer spending on interest rate-sensitive expenditures, like housing and automobiles, and slows businesses' investment in new equipment. The decrease in spending decreases the overall demand for goods and services in the economy, thereby reducing the demand/supply imbalances we have seen, and, consequently, reduce inflationary pressures. As a result, the inflation rate should fall back toward 2 percent, the FOMC's inflation rate target."

Should we assume rate cuts are going to spur more spending on housing and autos and businesses will invest more in equipment following the cut? What will that do to inflation now?

Do you really know? I don't.

Other smart people, like Torsten Slok of Apollo seem to feel differently. Take a look at some of the indicators on slide 7 of their deck. These counter arguments, which center on the possibility that the fight with inflation hasn’t definitely been won and that there is weak if any evidence that further loosening on monetary won’t risk reigniting inflation via the standard doctrine that it will increase spending, output, the wealth channel and ultimately inflation.

Monday, September 16, 2024

Daily Economic Update: September 16, 2024

-

Broken Bromance Trump and Xi talk, but Trump and Musk spar. I don’t know which headline matters more for markets, but shares of Tesla didn’...

-

FOMC day is here, what presents will Powell come bearing to the markets? Whatever the Fed does, it won't stop Fartcoin. Dow losing stre...

-

Another day, another dollar for the top dog with the gold flea collar - that's the S&P & Nasdaq which both set yet another all-t...

Daily Economic Update: June 6, 2025

Broken Bromance Trump and Xi talk, but Trump and Musk spar. I don’t know which headline matters more for markets, but shares of Tesla didn’...