"Mark your calendars. Unemployment fell to 3.6% in March 2022. Now it’s 3.7%. If it’s still relatively low in March 2025, and if inflation has fallen close to the Fed’s 2% target, then the US will have achieved its first ever soft landing. Three years of cyclically low unemployment without triggering high inflation is something that has frequently occurred in other countries (say the UK in the early 2000s), but never in the US. No one knows why.America’s been around for a quarter of a millennium, which is a long time. The early years are not well documented, but I’m pretty sure that we’ve never had a soft landing since at least the Civil War. And yet it seems like Wall Street prognosticators are increasingly of the view that the US will soon achieve a soft landing, our first ever."

"We think they are days from failure. They think it is a temporary problem. This disconnect is dangerous."

Thursday, December 14, 2023

Daily Economic Update: December 14, 2023

Wednesday, December 13, 2023

FOMC Recap: Performance Review Edition

- As expected the FOMC remained on hold for the third straight meeting, leaving the Fed Funds Target range at 5.25% to 5.50% with no changes to QT or other policies.

- The language in the FOMC Statement was less firm on the possibility of additional rate hikes.

- The Dots showed the Fed forecasting a 50bp lower 2023 Core PCE rate relative to estimates from September, as well as a 50bp reduction, from 5.1% to 4.6%, in the Median 2024 Fed Funds dot relative to September.

- Powell indicated the Fed remains fully committed to returning inflation to 2% goal, characterizing the current stance of policy as restrictive and cited the long and variable lags associated with monetary policy.

- Powell indicated that FOMC participants believe we are at the peak of interest rates.

- "Normalization Cuts" were discussed in the press conference, albeit poorly, but Powell acknowledged there was discussion as to when to start cutting rates as inflation cools.

- 2Y yields were down 20bps following the FOMC Statement and fell a further 10bps as Powell spoke, breaching 4.45%.

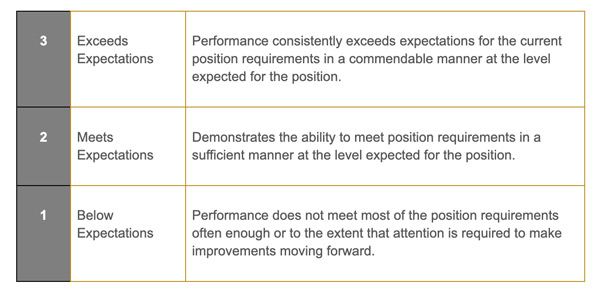

While progress has been made towards your goals, it's unclear how much of the success is attributable to your performance. You haven't done a great job of explaining your reaction function and often the market discounts what you are saying and believes you'll abandon your goals early if they complain loud enough. What is your reaction function? Are there rules you look at and follow to help you achieve your goals?

Your colleagues noted you did a lot of talking and many times that talking was distracting. We value a high "sit-next-to" factor here and it seems you can cause a lot of people anxiety. It seems like you spend most of your day just talking, when do you get work done? Oh, I see you think your job is mostly talking, propaganda, and suasion. We'll take this under consideration in 2024 goal setting.

Your track record of forecasting is not good. In 2024 maybe you should focus on the concept of "Margin Of Safety". In the words of Benjamin Graham in his classic book "The Intelligent Investor", Margin Of Safety is "in essence, that of rendering unnecessary an accurate forecast of the future". I know you're trying to balance both risk to unemployment and inflation, but look at where you need improvement, perhaps you might need to apply the Margin Of Safety concept to your inflation mandate.

Lastly, your performance was mixed on supervising your direct reports. Remember how several banks failed? You did a nice job of limiting the impact, but some find it troubling how this happened in the first place and how you seemed to miss the build up of economic and financial risk in years prior as well.

As we head into 2024, as you stay employed in your job of steering the most important economy in the world, I will remind you of some advice from the late, great Charlie Munger, "Nobody survives open heart surgery better than the guy who didn't need the procedure in the first place." You say you'd rather be Volcker than Burns, your goal for 2024 is to get inflation back to 2%. Let's try to get there without breaking something that will require open heart surgery.

Daily Economic Update: December 13, 2023

Tuesday, December 12, 2023

Daily Economic Update: December 12, 2023

Monday, December 11, 2023

Daily Economic Update: December 11, 2023

Tuesday: CPI, 20Y auction

XTOD: The Media Is Hyping Up "Carbon Passports" To Restrict Travel

Friday, December 8, 2023

Daily Economic Update: December 8, 2023

Thursday, December 7, 2023

Daily Economic Update: December 7, 2023

Wednesday, December 6, 2023

Daily Economic Update: December 6, 2023

-

We spend endless time debating the Fed’s neutral rate. Much less time asking whether the government can afford it. Enter Fiscal r-star : t...

-

U.S. yields start the day lower, with the 2Y down 4bps back at 5% and the 10Y down 6bps at 4.26%, both back to where they were pre-SVB (reme...

-

Yesterday the FOMC: Held their policy rate at 5.25-5.50% Raised their growth and inflation projections while keeping their median 2024 proj...

Edward Quince's Wisdom Bites: Low Ego

Nas closes his masterclass with a lesson on temperament: “The liquidity is high, but the ego is low / Light years ahead of where the paper u...